The holiday shopping season got off to a slower-than-expected start this week, with Amazon’s Prime Big Deal Days Concluding just as Hurricane Milton hit Florida. The back-to-back storms impacted consumer behavior, especially in the Southeast, with digital traffic down 6% in the region leading up to the event, according to Salesforce.

Retailers such as Target, Walmart, and Wayfair also launched competing October promotions, but weather interruptions added unexpected challenges to their campaigns.

📉Prime Day’s Performance: U.S. Struggles, Europe Thrives

Salesforce data reveals that on October 8, U.S. traffic dropped 4%, and online orders fell by 5% compared to the same period last year. Florida, in particular, saw a 10% traffic decline between October 5–8, as residents braced for the storm.

In contrast, European markets fared better, with 10% higher traffic and a 4% rise in online orders on October 8. Globally, web traffic grew 2%, but U.S. weather disruptions clearly made a dent in the overall results.

“Natural disasters consistently impact holiday sales,” said Kassi Socha, a retail analyst at Gartner. Logistics are also taking a hit, with delivery delays expected and demand shifting towards emergency supplies like food and flashlights.

📦 Retailers Adapt with Flexible Services and Perks

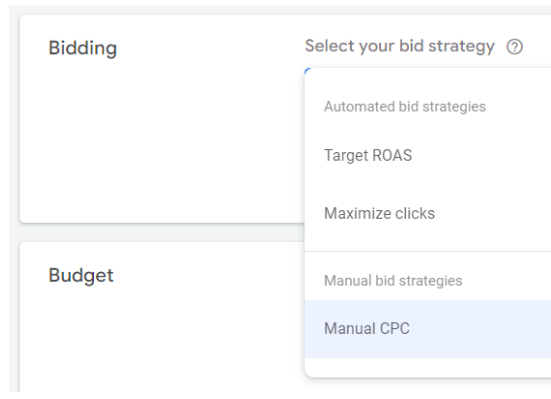

To offset the challenges, retailers have sweetened their offerings to attract early holiday shoppers:

- Extended return policies: Macy’s, Newegg, and Nordstrom Rack have moved up their holiday return windows to cover purchases made in early October through mid-January.

- Subscription incentives: Target 360 and Walmart+ programs are being highlighted for benefits like exclusive deals, free shipping, and early access to promotions.

- BOPIS & curbside pickup: With convenience driving consumer behavior, services like Buy Online, Pickup In Store (BOPIS) and same-day delivery are becoming essential.

According to a Gartner survey, 57% of consumers plan to use value-added services this holiday season.

🔍 Price Reigns Supreme: Discounts Drive Holiday Shopping Behavior

Despite the stormy weather, consumers are still focused on finding the best deals online. The same Gartner survey found that 20% of shoppers will increase their online shopping this year in search of better prices. Adobe predicts aggressive discounts across key categories like general apparel, beauty, and home goods, with average markdowns expected to reach 22% this week.

Marketers are also preparing for bigger promotions on higher-end goods, further catering to price-conscious consumers.

✨ The Road Ahead for Holiday Sales

While weather setbacks have slowed the initial holiday push, the season is far from over. Retailers are pivoting with extended services and aggressive promotions to meet evolving consumer needs. As the storm clouds clear, expect more intense competition and deeper discounts in the coming weeks to draw in both early and late shoppers.

Leave feedback about this