Loyalty programs are powerful tools to retain customers, reduce acquisition costs, and boost long-term revenue. But to prove their value and keep CFOs on board, it’s essential to measure key performance indicators (KPIs) that demonstrate financial impact. This newsletter breaks down six critical KPIs to track and manage loyalty programs effectively for profitability and sustainable growth.

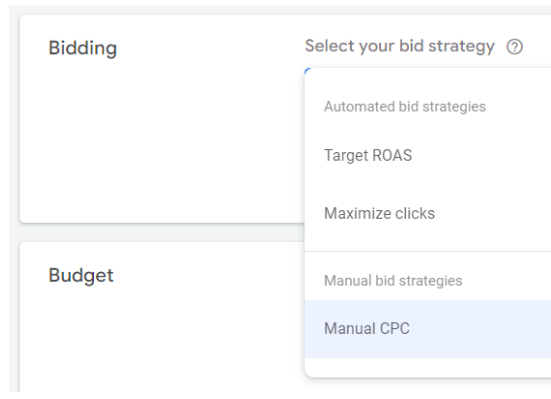

Measure and Maximize Program ROI

Program ROI shows the financial return on investment generated by a loyalty program relative to its costs. CFOs expect clear results that justify the investment in rewards and loyalty technology.

How to calculate ROI:

- Loyalty Contribution = (Revenue from loyalty members) – (Product cost + Rewards cost + Technology expenses)

- ROI = Loyalty Contribution ÷ (Technology Cost + Rewards Cost)

Some businesses focus on incremental revenue:

- ROI (Incremental Revenue Approach) = Incremental Revenue ÷ (Technology Cost + Rewards Cost)

This metric provides clarity on the profitability of loyalty initiatives, helping companies refine strategies to maximize financial outcomes.

Enhance Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) estimates the total revenue generated by a customer over their relationship with your brand. Loyalty programs are essential tools to boost CLTV, as they encourage repeat purchases, deeper relationships, and brand advocacy.

- Loyal customers spend more, stay longer, and are more likely to try new products.

- Happy customers bring referrals, reducing Customer Acquisition Costs (CAC).

- Higher CLTV means lower churn and better profit margins.

Tracking CLTV trends through loyalty programs allows businesses to measure long-term impact and report percentage increases to the C-suite.

Reduce Customer Acquisition Costs (CAC)

CAC measures the cost of acquiring new customers. A well-designed loyalty program can reduce CAC by increasing customer retention and driving word-of-mouth referrals.

- Referred customers are 15% more valuable than those acquired through paid channels.

- Lower CAC = More Efficient Marketing: Referrals from satisfied members reduce the need for costly marketing campaigns.

Loyalty programs provide a cost-effective way to grow customer bases, ensuring marketing budgets are used efficiently.

Boost Retention Rates to Improve Profitability

High retention rates reflect satisfied customers who are more likely to remain loyal, reducing churn and minimizing acquisition efforts.

Loyalty programs improve retention by offering:

- Personalized experiences: Welcome emails, targeted product recommendations, and birthday rewards.

- Ongoing engagement: Gamified tiers, exclusive content, and special offers between purchases.

By analyzing customer data, businesses can anticipate needs, tailor offers, and build lasting relationships that translate to higher retention and profitability.

Manage Points Liability to Maintain Financial Health

Points liability refers to the financial obligation created by unredeemed loyalty points. As customers accumulate points, companies must account for potential redemptions and the impact on balance sheets.

How to manage points liability:

- Calculate points earned minus points redeemed and assign a financial value to outstanding points (e.g., if 100 points = $1, each point is worth $0.01).

- Use expiration policies to minimize liability.

- Apply breakage rates based on historical redemption trends to estimate unused points.

Balancing rewards with financial risk is crucial to ensure loyalty programs remain sustainable without burdening the company’s finances.

Reduce Discount Rates & Drive Profitability

Excessive discounting can hurt profit margins, but loyalty programs offer an alternativeby enhancing perceived value and promoting full-price purchases.

Benefits of loyalty programs over discounting:

- Build deeper customer relationships to reduce price sensitivity.

- Encourage premium purchases by adding value through exclusive rewards.

- Generate new revenue streams by negotiating vendor contributions for loyalty promotions, offsetting the cost of rewards.

By shifting from short-term discounting to long-term customer engagement, businesses can protect margins and improve shareholder value.

Leave feedback about this