U.S. online holiday shoppers are expected to spend $240.8 billion this November and December, according to a forecast by Adobe. This is an 8.4% increase from last year’s holiday season, which had a growth rate of 4.9%.

Why It Matters

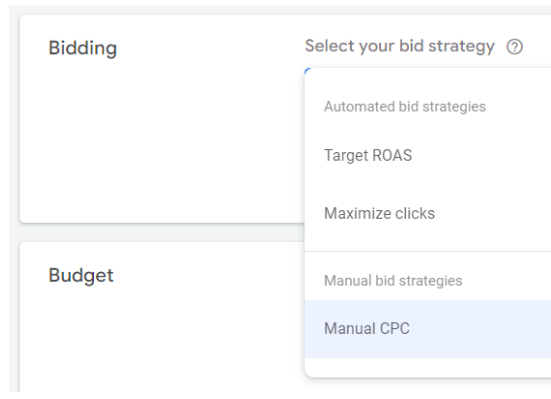

The steady consumer spending outlook is great news for retailers prepared with robust digital marketing plans. With 80% of shoppers planning to spend the same or more than last year, businesses have a prime opportunity to capture a significant share of holiday budgets. Those with the right marketing tactics—like personalized ads, targeted emails, and loyalty programs—can position themselves to thrive, especially given the evolving holiday shopping behavior. 🎯

One noticeable trend is the shift toward early holiday sales events. Retailers are increasingly launching promotions ahead of the traditional Black Friday rush, with Amazon’s Prime Big Deal Days on October 8 and 9 kicking off the season. Early sales events are becoming essential for shoppers who want to avoid the last-minute frenzy and spread their spending across a longer period.

In addition, many consumers are buying gifts throughout the year, opting for convenience and flexibility. This change highlights the importance of having an always-on marketing strategy that engages customers year-round, not just during peak seasons. Promotions, retargeting campaigns, and strategic product drops throughout the calendar can help retailers maintain relevance and drive consistent sales.

For businesses, understanding these spending trends and adapting to them ensures they stay ahead of the competition. Retailers that leverage early events, optimize digital channels, and align with evolving consumer behavior will be well-positioned to maximize holiday revenue and drive growth.

Mobile Shopping Growth 📱

Mobile shopping is set to reach new heights this year, with $128.1 billion in expected sales, up 12.8% from last year. This means that mobile purchases will make up 53.2% of all online shopping. This trend can be attributed to several factors. First, mobile technology has become more sophisticated, allowing for smoother and faster shopping experiences. Retailers are investing in mobile-friendly websites and apps, ensuring that customers can easily browse, compare, and purchase products with just a few taps.

Cyber Week Boost

Cyber Week, which includes the five days from Thanksgiving to Cyber Monday, is expected to generate $40.6 billion in sales, marking a 7% increase from last year.

Changing Spending Patterns

Adobe has found that, over the last five years, the sale of cheaper goods rose by 46%, while the sale of more expensive items fell by 47%. However, this year, sales of high-end goods are expected to increase by 19% due to discounts rather than an overall increase in shopper wealth.

Holiday Spending Trends

As the holiday season approaches, most consumers are signaling a consistent or increased willingness to spend. 80% of shoppers plan to spend the same or more than they did last year, with 19% indicating they’ll increase their holiday budgets and 61% expecting to maintain last year’s spending levels. This stability suggests that, despite economic uncertainties, consumers are prioritizing holiday shopping as an essential part of their annual routines. 🎁

Interestingly, less than half (48%) of consumers reported that inflation will impact their spending decisions. This indicates that while rising costs may be a concern, many shoppers are either adjusting their budgets or absorbing higher prices without significantly changing their behavior. Retailers can take advantage of this trend by focusing on value-based messaging, loyalty programs, and early promotions to attract customers and maximize seasonal revenue.

Understanding these spending patterns is key to developing strategies that resonate with consumers and capture a larger share of their wallets during this crucial season.

Generational Shopping Differences

Both Gen Z and Baby Boomers are likely to shop online and in stores, but more than half (53%) of Gen Z shoppers plan to do most of their shopping online, compared to only 25% of Baby Boomers.

Overall, understanding these trends will be key for retailers looking to make the most of the upcoming holiday season! 🎉

Leave feedback about this